Taxes off a paycheck calculation

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

For instance an increase of.

. Over 900000 Businesses Utilize Our Fast Easy Payroll. Free salary hourly and more paycheck calculators. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

Your average tax rate is 270 and your marginal tax rate is 353. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Sign Up Today And Join The Team.

Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Total annual income Tax liability.

Your average tax rate is 217 and your marginal tax rate is 360. Over 900000 Businesses Utilize Our Fast Easy Payroll. Ad See the Paycheck Tools your competitors are already using - Start Now.

Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. The information provided by the Paycheck. Ad Compare This Years Top 5 Free Payroll Software.

Sign Up Today And Join The Team. Learn About Payroll Tax Systems. This marginal tax rate means that your immediate additional income will be taxed at this rate.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. This marginal tax rate means that your immediate additional income will be taxed at this rate. For example if you earn 2000week your annual income is.

Ad Payroll So Easy You Can Set It Up Run It Yourself. For instance an increase of. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Fast Easy Accurate Payroll Tax Systems With ADP. For instance an increase of.

Determine if state income tax and other state and local taxes. Free Unbiased Reviews Top Picks. Discover Helpful Information And Resources On Taxes From AARP.

All Services Backed by Tax Guarantee. Read reviews on the premier Paycheck Tools in the industry. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Use this tool to. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. Learn About Payroll Tax Systems. This makes your total taxable income.

How do I calculate taxes from paycheck. Your average tax rate is 220 and your marginal tax rate is 353. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

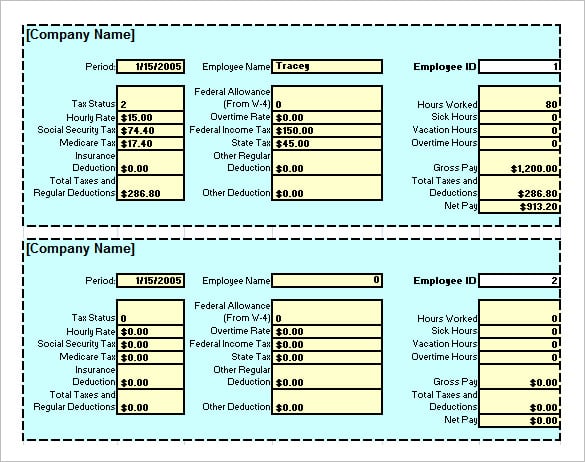

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

California Paycheck Calculator Smartasset

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Understanding Your Paycheck

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

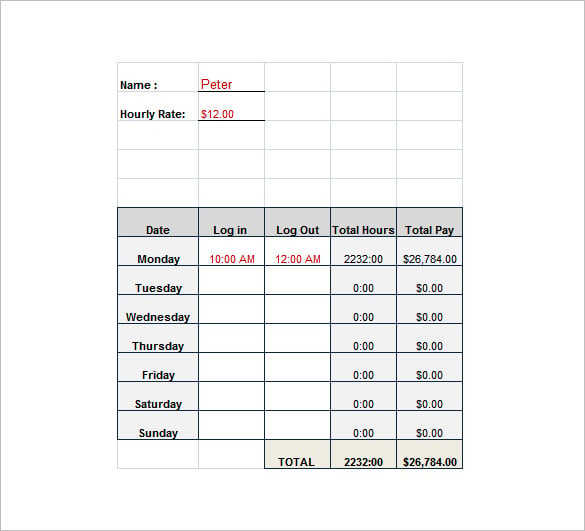

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Here S How Much Money You Take Home From A 75 000 Salary

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek